Many people are not appearing to understand what good prepayment punishment was, much on the very own detriment weeks otherwise decades immediately following signing home loan financing data.

As an alternative, its hidden throughout the records and glossed more because of the consumers which was eager to romantic on their mortgage loans and you will progress.

Regrettably, this might be an expensive error if however you split the principles, if you know they or perhaps not.

There are two Type of Prepayment Charges

- There are mellow prepays and hard prepays

- A silky prepay allows the latest business of the house rather than punishment

- However, penalizes you for folks who re-finance the loan

- A hard prepay penalizes your to possess property selling otherwise a mortgage re-finance

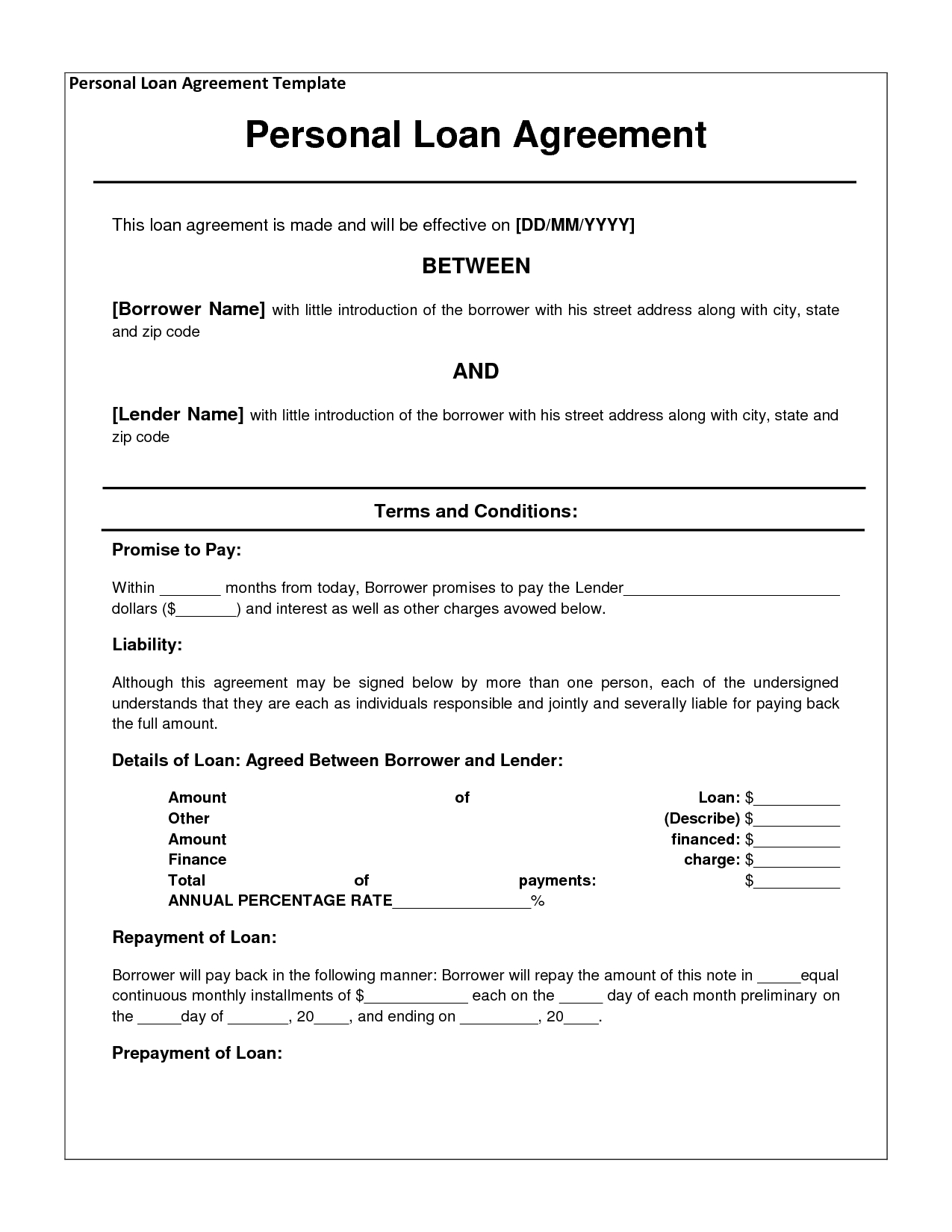

An excellent prepayment penalty, also known as a great prepay in the market, was a contract anywhere between a debtor and you can a lender or financial lender you to manages what the borrower was permitted to pay off incase.

Up until now, you are thinking why must someone spend over 20 per cent of the financial off in a single 12 months? Well, convinced outside the field a while, settling a mortgage very early may seem in several various methods.

For many who promote your house, that’s one way to repaying the borrowed funds entirely. Of course, if your refinance the borrowed funds, your effortlessly repay the mortgage as well by replacement they with a bright new one.

Having said that, you will need to keep in mind that there are two version of prepay penalties. These are typically flaccid prepayment penalties and you can tough prepayment penalties.

A silky prepayment punishment lets a debtor to sell their house anytime instead of punishment, however, if it prefer to refinance the borrowed funds, they’ll certainly be subject to brand new prepayment punishment.

A difficult prepayment punishment , likewise, sticks the fresh debtor having a penalty if they offer their home Or refinance its home loan.

Without a doubt, here is the difficult of these two, and generally brings a debtor no option of jumping watercraft if the they have to sell their house rapidly just after obtaining a home loan.

Very prepays only past step one-three years, in case that you ought to re-finance or offer your house instantly, the latest prepayment punishment can be hugely really serious.

- It does are very different of the financial

- Nonetheless it is 80% from 6 months appeal

- Definition half a year of great interest-merely mortgage repayments, increased https://paydayloanalabama.com/sanford/ from the 80%,

- That can be very costly according to loan amount and you may rate of interest

It will will vary, but in our analogy it is 80% because the bank allows the debtor to settle 20% of one’s loan balance yearly, therefore the penalty just hits new debtor to have 80%.

The brand new six months appeal ‘s the attract-only portion of the mortgage repayment the debtor secured when they grabbed from home loan.

So if a debtor possess a home loan rate regarding six.5% into a great $500,000 amount borrowed, their interest-only percentage arrives so you’re able to $ monthly.

Multiply you to definitely by the 6 months, need 80% of one’s overall, and also you get a hefty prepayment punishment regarding $thirteen,000.

$five hundred,000 loan amount Rate of interest out of 6.5% Monthly homeloan payment from $2, 6 monthly payments = $16, 80% of these six monthly payments = $thirteen,

So why the new prepay, anyhow?

- Prepayment penalties protect the lender/trader just who requests the borrowed funds

Prepayment penalties was developed to guard loan providers and you can dealers one depend toward a long time regarding profitable interest payments to make money.

When mortgages was paid back rapidly, regardless of whether by the re-finance or a home product sales, less overall than just in the first place envisioned could be produced. It is an easy layout.

In the event that in reality, much less is understood, the latest owners of these mortgages would not profit because they to start with expected. Making it clearly reduced common just in case you secure the loan.

This is exactly essentially a method for those with an interest for the your own mortgage to make certain it get things right back, it doesn’t matter how long the borrowed funds are kept ahead of getting reduced from.

The good thing, while a debtor, would be the fact a mortgage which have a good prepayment penalty attached can come which have a slightly down rate of interest, all things becoming equal.

This is exactly like how a supply costs below an excellent fixed-rates home loan, because the you are taking a risk of a performance reset into the former.

While you are happy with your home plus financial, and you will feel comfortable so you can lock oneself on property to possess an excellent while, you can look at getting a prepay to reduce their interest.

Just be sure this new prepay is actually helping you save money and you will cutting your rate enough to make a bearing.

Be cautious about Prepayment Punishment!

Be mindful when considering a mortgage that have a prepayment punishment. Whilst not as popular now because they were during the early 2000s, they might be added to mortgages provided by collection lenders, exactly who set her laws and regulations.

Even though a mortgage which have a beneficial prepayment penalty can come having good much lower interest rate, it will go back to haunt you if you would like refinance earlier than organized, when the home loan pricing shed notably, or if you want to promote your house earlier than your expected.

In the construction increase back to 2004-2006, most higher finance companies for example Wells Fargo don’t fees prepayment charges, but some quicker loan providers usually performed to contend to your price into large banking institutions.

Be sure to know very well what you get just before it’s too-late! If you discover aside about an unwanted prepayment penalty late in the overall game, thought exercising the correct regarding rescission.

Tip: There are no prepayment punishment into FHA financing, which is among the several benefits in accordance with traditional loans.